Check out the full comparison table

Environmental contribution schemes

Unlocking the true value of Carbon, Plastics & Biodiversity credits

Executive Summary

A brief history of voluntary environmental markets

CARBON

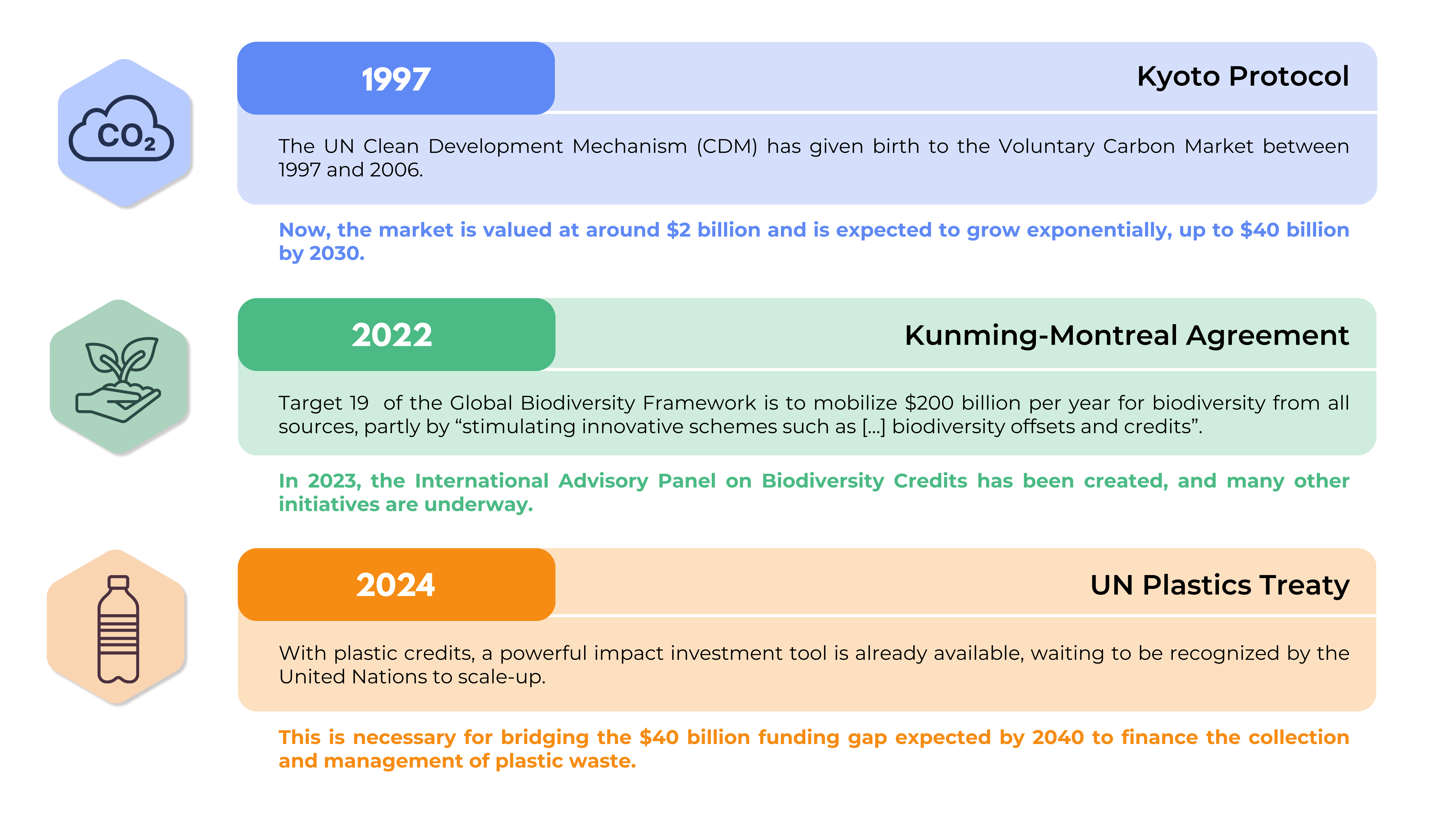

First it is important to precise that the United Nations itself has given birth to the Voluntary Carbon Market, back in 1997 during the Kyoto Protocol. As compliance carbon markets were setting up in some countries, such as the European Union Emissions Trading System (EU-ETS), other parts of the world were lacking the regulatory frameworks and the infrastructure required for implementing similar schemes. The Clean Development Mechanism (CDM) was then elaborated, for Northern countries to contribute to the sustainable development of the Global South on a voluntary basis. At the same time, carbon footprint methodologies were emerging and spreading all around the world (Bilan Carbon Ademe, GHG Protocol…). In the late 2000s, voluntary carbon market began to take shape more formally as a growing number of organizations sought ways to address their carbon footprints.

UN support and growing demand enabled the proliferation of independent certification standards, such as Gold Standard (2003) and Verra (2005). Competition between standards has made them improve on key integrity principles such as additionality, permanence and monitoring. Surely, Voluntary Carbon Markets have known their ups and downs. Twenty years later, improvements are still to be made – but new governance bodies such as ICVCM, VCMI, CORSIA… have already reinforced market integrity. Overall, this investment mechanism has already helped finance high-integrity impactful projects at scale. And it is still one of the most powerful tool we have to support positive environmental and social impacts worldwide. The market was estimated to be worth around $2.5 billion in 2023, with a projected market value of $30 – $100 billion by 2030.

BIODIVERSITY

That is why, inspired by the carbon market – and learning from the challenges it has already faced – a biodiversity credit market has been emerging in recent years. Still nascent, and with some challenges to be solved, this innovative instrument will finance biodiversity preservation or restoration projects in countries that require it the most.

The United Nations promoted biodiversity credits through the adoption of the Kunming-Montreal Global Biodiversity Framework (GBF) in December 2022, seeing it as a key element to “halt and reverse biodiversity loss by 2030”. Target 19 of the Global Biodiversity Framework emphasizes the need for mobilizing resources through diverse mechanisms – including biodiversity credits – to address the biodiversity funding gap of $700 billion per year.

This has brought powerful political support with the creation of dedicated taskforces such as the International Advisory Panel on Biodiversity Credits (IAPB), led by France and the United-Kingdom. Other organizations are now working together for defining the future of the market: World Economic Forum (WEF), Biodiversity Credit Alliance (BCA), Organization for Biodiversity Certificate (OBC)… Independent standards are also designing innovative methodologies and converging towards a common definition of a biodiversity credit unit.

Biodiversity credit market could reach between $6 billion and $10 billion annually by 2030. Some volumes of biodiversity credits have recently been sold – and biodiversity-enhanced carbon credits are already selling out for years. Market is likely to know an exponential growth in the years to come.

PLASTIC

A similar market structure applies for plastic credits as well. It gained traction when Verra, the most famous standard from the carbon market, launched its Plastic Waste Reduction Program back in 2021. It is providing a new way to fund plastic collection and recycling projects, which is highly required for bridging the $40 billion funding gap for addressing waste management worldwide by 2040. Other private initiatives such as standards (Ocean-Bound Plastic, Plastic Credits Exchange…) and project developers are now up and running – waiting for the incoming United Nations’ recognition to scale up.

Voluntary environmental markets: the major role of the United Nations

Comparison of the three credit types (Carbon, Plastic, Biodiversity)

The urgency for environmental action is high across all three types of credits, with carbon credits being the most critical due to their role in combating climate change. Carbon emissions are the highest investor risk and draw the strongest consumer pressure. Both plastic and biodiversity credits also carry significant urgency, with biodiversity loss ranking as a top-three global risk. In all three places, major investments are required to mitigate these risks.

The maturity of each credit market varies significantly. Carbon credits represent the most established market, with over 20 years of history and well-defined standards. Plastic credits are an emerging market, with a growing number of project certifications and transactions, while the market for biodiversity credits is still in its nascent stage, with ongoing efforts to define measurement units and standards.

Though carbon credits, plastic credits and biodiversity credits are based on similar market principles, inherent differences are worth noticing.

Each credit type has its own metric for measuring impact. Carbon credits are measured by the amount of carbon sequestrated or avoided, while plastic credits focus on plastic waste collected or recycled. Biodiversity credit metrics are still hard to establish due to the inherent complexity of Nature. All market players are working towards setting up a harmonized metric for all standards.

Overall, the governance structures are also evolving, with established bodies overseeing carbon credits, and similar organizations emerging for plastic and biodiversity credits. All three investment instruments are converging towards enhanced market integrity and transparency.

Market integrity is here – yet some areas of improvement remain

Surely, carbon markets have known their ups and downs. But it is now converging towards a sustainable high-integrity market, as an essential part of the climatic maze. Biodiversity and Plastic credit markets are learning from its best practices to get it right directly.

Here are some of the key challenges remaining for those three markets:

Transparency: on all three markets, this is necessary to build trust and eliminate the risk of greenwashing, both on the demand and supply.

Monitoring, Reporting and Verification: all environmental impacts need to be calculated and/or measured. Of course, it’s not perfect. But carbon footprint emissions factors aren’t either – and it doesn’t mean that it is not crucially essential. Monitoring is key to ensure that impacts are additional, real, measurable, and permanent. Accurately quantifying biodiversity improvements is far more complex than measuring carbon emissions, that is why disruptive technologies are developing such as drone image recognition and e-DNA.

Just Transition: those in the frontline of environmental efforts must be taken into account. This includes – but is not limited to – Indigenous People & Local Communities, waste pickers communities, and any vulnerable group in projects’ geographical areas. Benefit sharing is a key element for enabling social empowerment. Environmental credits are not just about impact reduction. They can be a powerful vector for modernisation and social justice.

Governance: we should avoid a fragmented landscape with different standards for credit issuance, validation and trading that will weaken market integrity on the long run. Harmonized and global governance structures are required to ensure market integrity and prevent exploitation of loopholes in the system.

Starting now benefits to everyone

Removall proposes a new holistic environmental approach for corporates to take action now by financing carbon, plastics and biodiversity impact projects.

Contributing to Nature in parallel with internal reduction impact strategies is a guarantee to:

Price negative environmental externalities internally – therefore reallocating the capital in the right place.

Raise awareness towards customers, employees and investors – and onboard everyone in the transformation journey.

Anticipate regulatory evolutions that might arise sooner than expected.

Make concrete positive Nature impacts, enhancing the lives of marginalized communities.

Those investments are necessary for preserving our Earth. They can also provide an important ROI if included into holistic sustainable approaches and valued in a comprehensive and transparent communication plan.

Want to know more?

Article written by :

Project Manager - Innovative Environmental Assets