Corporate Emissions Performance and the Use of Carbon Credits

To investigate whether carbon credit users have reduced emissions faster or slower than non-users, MSCI analyzed constituents of the MSCI ACWI Investable Markets Index (IMI) from 2017 to 2022.

The use of carbon credits has been the subject of some criticism, including the assertion that companies that spend money on carbon credits commit fewer resources to reducing their own emissions.

To investigate whether carbon-credit users have reduced emissions faster or slower than non-users, we analyzed constituents of the MSCI ACWI Investable Markets Index (IMI) from 2017 to 2022.

MSCI analysis found that those companies that used a “material” amount of carbon credits were, on average, more likely than non-users to have:

- Disclosed their emissions

- Reduced their Scope 1 and 2 emissions

- Reduced the intensity of their Scope 1 and 2 emissions

- Set a climate target, and for that target to be of high credibility

- Earned a higher proportion of their revenues from low-carbon activities

These findings contradict the notion that companies have used carbon credits as an alternative to investing in climate-mitigation activities within their businesses.

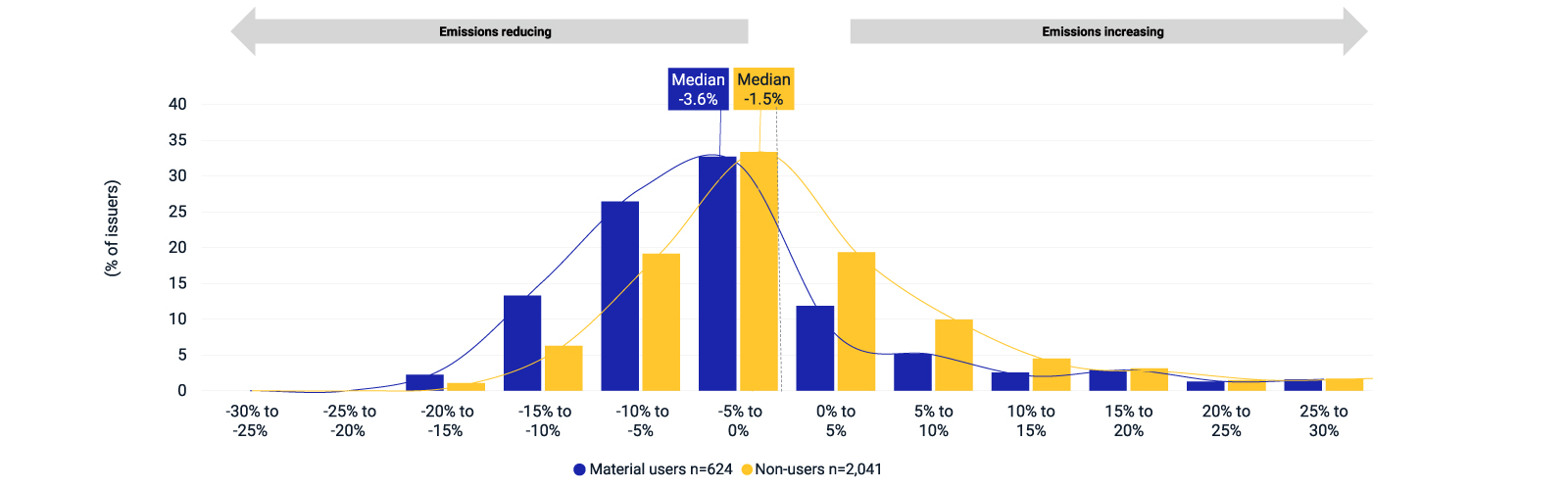

Distribution of annualized change in company-reported gross Scope 1+2 emissions for material carbon-credit users and non-users, 2017-2022

Data as of July 1, 2024. Only includes firms within the MSCI ACWI IMI that reported their Scope 1 and 2 emissions for every year between 2017 and 2022. Source: MSCI Carbon Markets, MSCI ESG Research

Article written by :

Ellie Dana

Head of Marketing & Communication - Removall Carbon